In the world of financial markets, keeping a watchful eye on key indices and currency pairs is essential for traders and investors alike. Recent developments in the NAS100, US30, and EURUSD provide interesting insights into the current market dynamics. Let's delve into these market movements and what they might mean for traders.

The US30 Performance

(UPDATE) - The bulls are ready.

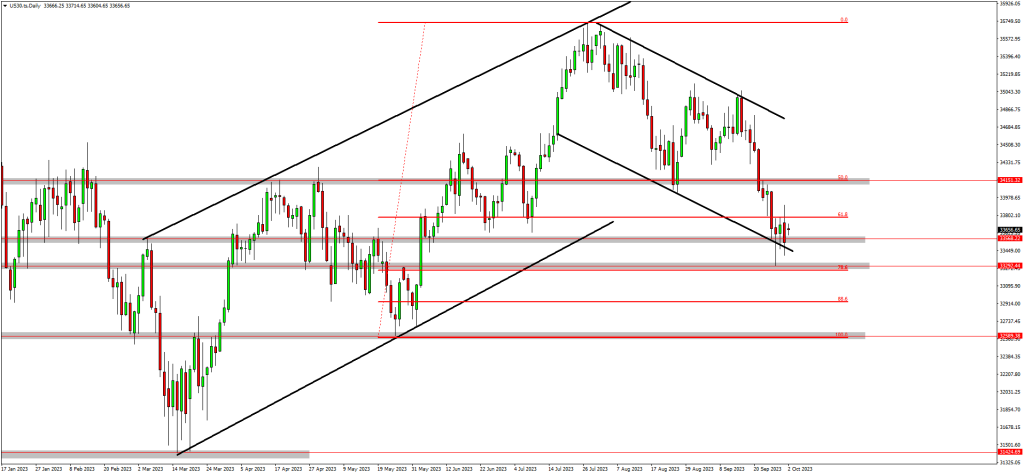

US30 is currently trading at critical technical zones which are the lows of the descending structure. Additionally, the support zone around 33568.00 and it recently bounced off the 78.6 fib level and the 33292.44 support zone. The previous 3 daily candlesticks failed to continue creating new lows and in turn, forming a double bottom on the H4 timeframe.

Could this be a sign that the sellers starting to secure their profits? According to this price action traders are bullish and anticipate these zones to act as a PRZ for the market and start rallying to the upside. As such, traders will wait for the lower timeframes structures to be broken to the upside to align different timeframes together in one direction before looking for trading opportunities.

The EURUSD Performance

EURUSD is bouncing from the support zone.

EURUSD has created a bearish market structure (trend) as seen in the H4 timeframe. The trend has broken below previous key support zones and overall is trading within a descending channel. This price action has caused traders to long the USD against the EURO. At the moment the market has bounced from the support zone around 1.05112 which is aligned with the bottom of the channel.

According to this price action sellers would want to start securing profits as these technical zones could be a barrier to price and provide confluence for a bullish wave. As such, the probabilities of a recovery back to the top of the channel are high and could provide short-term trading opportunities.

The NAS100 Performance

(UPDATE) - Is the pattern complete?

NAS100 is trading within a bullish trend which has broken above the key resistance zones and has shown bullish momentum. Recently the market went into a corrective phase which formed a bullish continuation pattern with the possibility of forming 3 lows before the pattern

completes and at the moment the market has rallied up from the 3 low.

According to this price action traders are bullish and anticipate the trend to resume at any point from these levels. As such, traders will monitor the lower timeframes and wait for confluence before looking for trading opportunities.

Read More: The Ultimate Forex Trading Checklist

Final Thoughts On Today’s Analysis

In the world of finance, staying informed about market developments is paramount. The recent movements in the NAS100, US30, and EURUSD provide valuable insights for traders. While the NAS100 shows signs of an upward push, the US30 and EURUSD have found support zones. Moreover, it offers opportunities for traders to navigate these markets effectively.

As always, it's crucial to conduct thorough research, consider risk management strategies, and stay informed about global markets. Watch our YouTube channel today to learn more about our analysis and daily market commentary.