According to recent market data, traders are expressing short-term bearish sentiment towards gold, silver, and bitcoin. This sentiment is reflected in the downward trend of these asset prices, as traders are selling their positions in anticipation of further price drops.

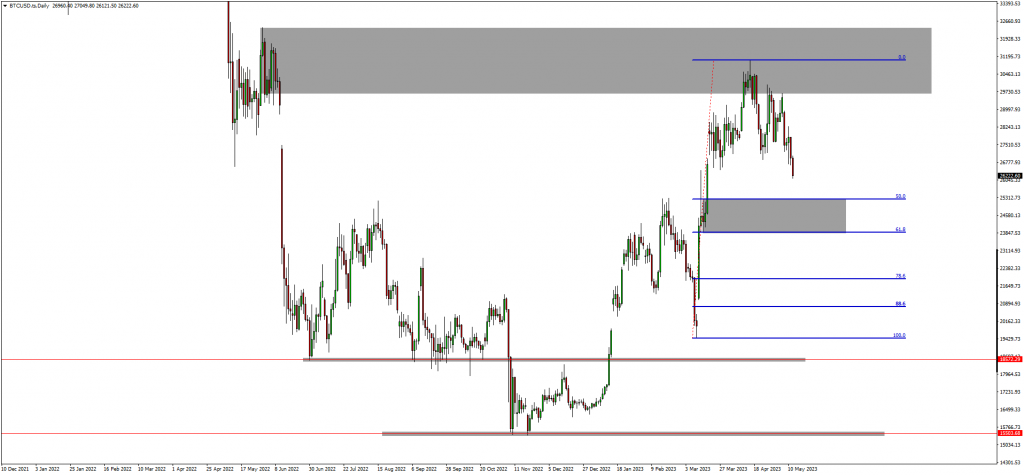

The BTCUSD (Bitcoin) Performance

BTCUSD is starting to form lower lows and lower highs.

BTCUSD recently rejected the supply zone and started to develop a descending structure. The Fibonacci taken on the previous bullish impulse wave suggests that traders anticipate BTCUSD to drop down to the 50.0 - 61.8 fib zone where it is aligned with the support zone and the demand zone before any reaction. As such, traders will be looking for a retracement as confirmation for a continuation to the fib zone.

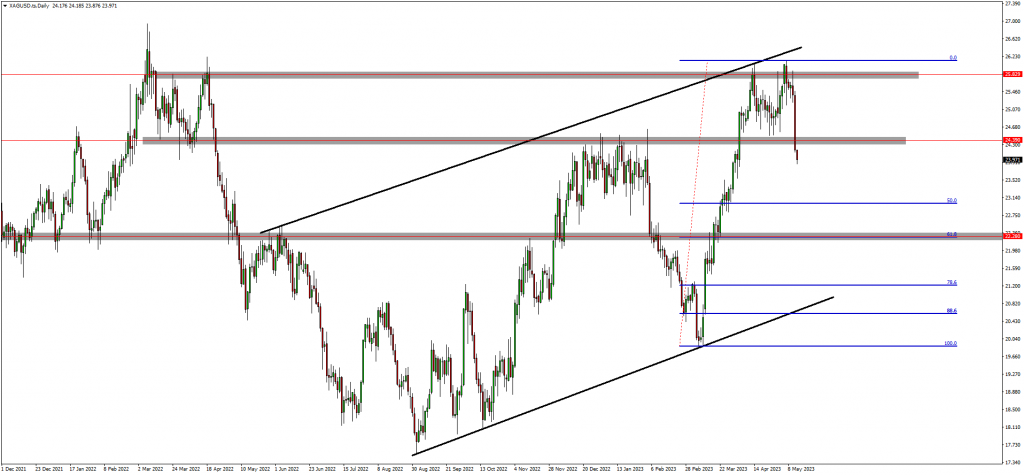

The XAGUSD (Silver) Performance

Silver down to the 50.0 fib level.

Silver is trading within a bigger ascending structure. Recently the market aggressively dropped from the top of the channel and broke below the support zone. This price action indicates that there's momentum from the sellers. According to this price action, traders anticipate Silver to push down to the 50.0 fib level and close this week bearish. As such, a retest of the broken structure will likely cause a continuation to the downside.

The XAUUSD (Gold) Performance

(UPDATE) - GOLD down to the bottom of the ascending structure.

Gold, which has historically been viewed as a safe-haven asset, has seen a decline in demand as inflation concerns ease. Moreover, the Federal Reserve maintains its current monetary policy. In addition, the strengthening of the US dollar has also contributed to the downward pressure on gold prices.

The recent price action on GOLD suggests that the buyers are exiting their positions as the market recently hit the target around 2070.00 and completed the bullish setup. On the lower timeframes, the market is breaking below structure levels and creating lower highs which suggest that there is currently bearish momentum.

According to this price action, traders anticipate the market to continue to the downside and hit the bottom of the channel to complete a short-term bearish trading opportunity.

Final thoughts on today’s commentary

In conclusion, the short-term bearish sentiment towards gold, silver, and bitcoin should not discourage traders from considering these assets. While traders may be selling in the short term, the long-term outlook for these assets remains positive.