In the fast-paced world of financial markets, trader sentiment often plays a significant role in determining the direction of currency pairs and indices. Recent trends in the foreign exchange market indicate a bearish outlook on GBPCAD and GBPAUD, while the NAS100 index has seen a bullish sentiment take the lead. In this article, we'll delve into the factors contributing to what traders should consider when navigating these markets.

The GBPAUD Performance

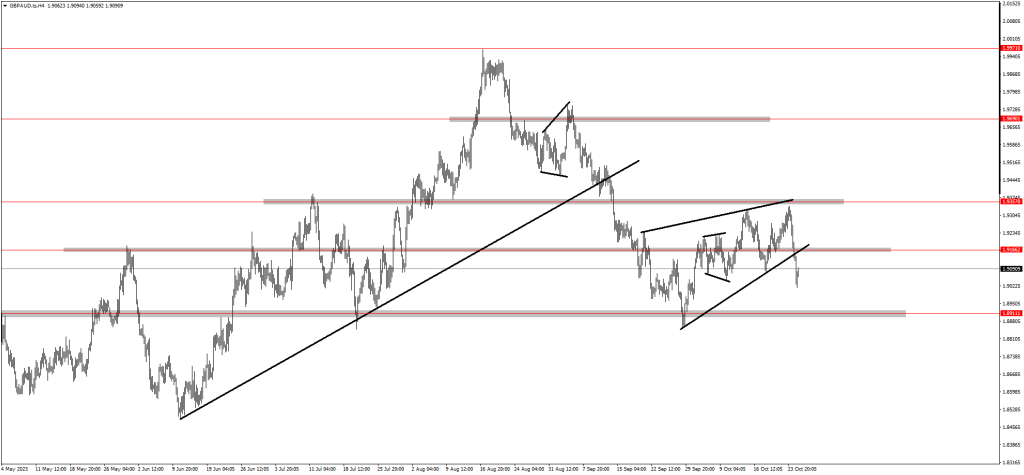

GBPAUD broke out of a structure.

GBPAUD is currently trading within a bearish trend after creating a high of around 1.99700. The nature and behaviour of this particular trend are such that it breaks below support zones and retests. Moreover, the resistance zones before creating a lower low and confirming bearish momentum. Recently the market broke out of a corrective pattern and broke below the support zone around 1.91660.

According to this price action, traders anticipate the trend to resume and continue trading lower. As such a retest of the structure and the resistance zone around 1.91660 will create a lower high and increase the probability of a drop which could provide trading opportunities.

Read More: How Do Limit Orders Work on a DEX?

The GBPCAD Performance

GBPCAD is currently in a corrective phase.

GBPCAD is trading within a bearish trend as seen by the double top around the 1.73110 resistance zone and a break below the neckline and previous support zone around 1.68530. At the moment the market is forming a bearish continuation structure and is likely to create a lower high. According to this price action traders are bearish and anticipate the market to retest the top of the structure and the resistance zone before resuming the trend.

The NAS100 Performance

Is NAS100 ready to push up?

NAS100 has gone back to the bottom of the descending structure and the support zone around 14545.00. According to the previous price action buyers were found around these zones as seen by how the market aggressively pushed up.

Traders are keeping a close eye on this market and are waiting for a break above the inner descending channel as well as the resistance zone around 14858.00 before looking for trading opportunities to the upside.

Final Thoughts On Today’s Analysis

In conclusion, In the ever-shifting landscape of financial markets, trader sentiment is a key driver of currency pair and index movements. Currently, traders are leaning towards a bearish outlook on GBPCAD and GBPAUD, primarily due to economic uncertainties and divergent monetary policies. In contrast, NAS100 enjoys bullish sentiment thanks to strong corporate earnings, the tech sector's dominance, and supportive monetary policies.

Traders must remain vigilant, as market sentiment can change rapidly. Staying informed about economic developments, geopolitical factors, and central bank actions is essential for making informed trading decisions. Always remember that trading carries inherent risks, and a well-thought-out strategy is crucial for success in the financial markets. Subscribe to our YouTube channel today to learn more.