In the dynamic world of foreign exchange markets, traders are always on the lookout for signs and signals that can help them make informed decisions. Currently, there is a growing anticipation among traders of short-term weakness in the US Dollar (USD) against the Canadian Dollar (CAD) and the Australian Dollar (AUD). This shift in sentiment is driven by a confluence of factors that are shaping the forex landscape in interesting ways.

The USDCAD Performance

(UPDATE) - USDCAD dropped +90 pips from the resistance zone.

USDCAD/USD is trading within a descending structure. It recently broke above the inner ascending structure and continued to rally up to the resistance zone around 1.36572. The market previously failed to break above the zone and has recently dropped +90 pips from the zone.

Traders anticipate the zone to hold the market and the USD to weaken against the CAD. As such, traders will keep an eye on the lower timeframe break of structure to identify a trading opportunity.

The US30 Performance

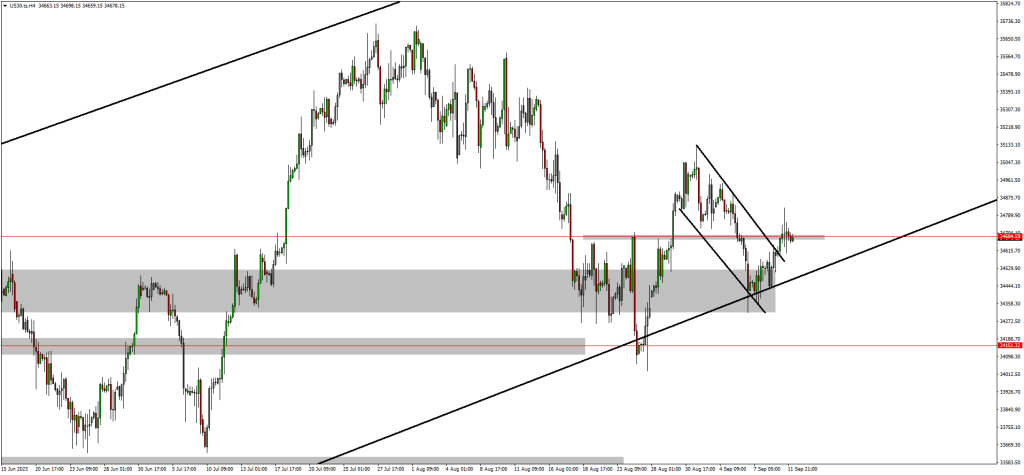

(UPDATE) - US30 broke above the inner descending channel.

US30 is trading within a weekly timeframe bullish trend and ascending channel. Recently the market retraced to the lows of the channel and the support zone and rallied to the upside. This price action confirmed a bullish continuation.

At the moment the market has broken above the inner channel however is struggling to break past the resistance zone around 34684.60. According to the weekly and daily timeframe price action, traders are bullish and anticipate the market to rally back to the weekly timeframe structure high. As such, traders will use the break above the resistance zone and the retest as a confirmation and to identify trading opportunities.

Read More: GBPJPY Reached The Target & Focus Is Now On US30 and AUDUSD

The AUDUSD Performance

(UPDATE) - AUDUSD is 30 pips away from the target.

AUDUSD is trading within a descending structure and recently bounced from the lows as well as the support zone around 0.63720. According to the last commentary, the market had just rejected the support zone and was trading a few pips away from it.

At the moment the market has rallied +60 pips and is close to the target set at 0.64555. According to this price action, traders anticipate the market to reach the target and possibly break above the resistance.

Final Thoughts On Today’s Analysis

It's important to note that forex markets can be highly volatile, and short-term forecasts are subject to change rapidly. Therefore, traders should remain vigilant, and stay informed about economic developments. Furthermore, consider risk management strategies to navigate the ever-evolving forex landscape.

In conclusion, traders are closely watching the evolving dynamics of the forex market. Moreover, a growing anticipation of short-term weakness in the US Dollar against the Canadian Dollar and the Australian Dollar. Economic indicators, central bank policies, commodity prices, risk sentiment, and technical analysis are all contributing factors to this outlook. Subscribe to our YouTube channel today to learn more.