In the complex world of financial markets, traders are always on the lookout for opportunities to capitalise on potential trends. Recently, market sentiment has been notably positive towards precious metals, particularly SILVER and GOLD, as traders anticipate a resurgence of their bullish trends.

However, a contrasting sentiment has emerged for the AUDNZD currency pair, with traders expressing a bearish outlook. In this article, we delve into the factors driving these sentiments and explore the potential implications for traders.

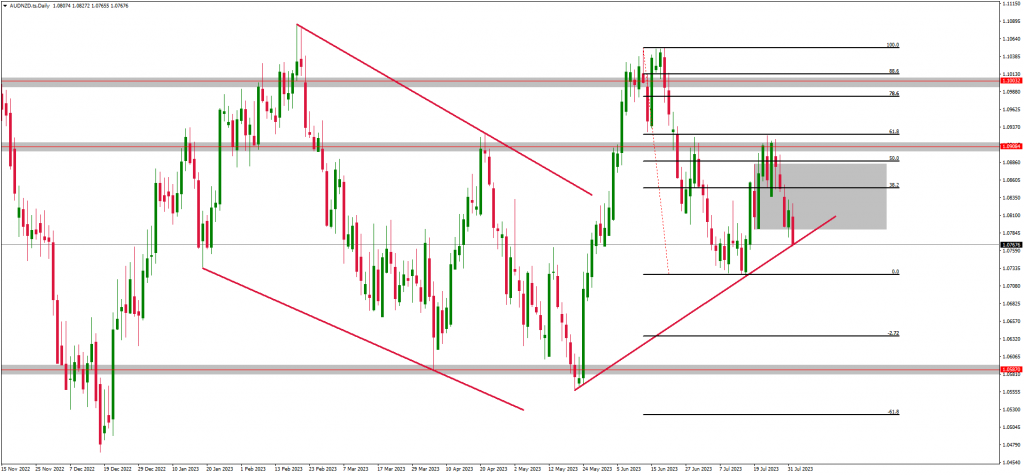

The AUDNZD Performance

Breakout is due on AUDNZD.

AUDNZD's recent price action indicates that there's a battle between the bulls and the bears however the support zones that the market has been breaking suggest that the bears could come out victorious. The market failed to break above the resistance zone around 1.10000 and created a double top.

This caused an aggressive drop below the previous support zone around 1.09080 which turned into a resistance zone as seen by the retest. A break below the ascending trendline will likely see a drop back to the support zone around 1.05870.

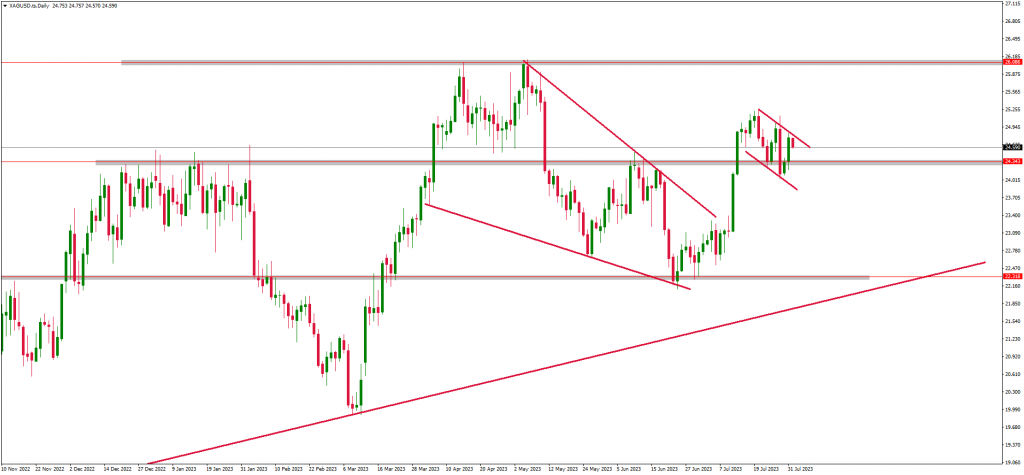

The XAGUSD (SILVER) Performance

Silver is set for a continuation.

Silver recently rejected the support zone around 22.318 which was the bottom of the descending structure. This price action saw the market breaking above the structure and above the resistance zone around 24.343. Traders are bullish according to this price action and will likely use the bullish continuation structure that's currently forming for trading opportunities to the upside. As such, a break and close above the pattern will resume the bullish trend.

The XAUUSD (GOLD) Performance

GOLD preparing for a huge move.

GOLD rejected the weekly timeframe support trendline and started forming an ascending market structure which broke above the descending channel as well as the previous resistance zone around 1938.30. This price action confirmed that there is bullish momentum in the market. Recently the market failed to break above the resistance zone around 1985.24 and has formed a descending structure.

At the moment, the market is trading in between the resistance and the support zone. According to this price action, traders are sitting back and observing how the market will react to the structure however a break and close above the resistance zone will cause momentum to the upside.

Read More: EUR, AUD & NZD Against The JPY This Week?

Final Thoughts On Today’s Analysis

Traders are closely watching the silver and gold markets as they anticipate the resumption of the bullish trend. Silver's role in sustainable energy technologies and industrial applications, combined with its historical significance as an inflation hedge, has positioned it for growth in the coming months. Meanwhile, gold remains a favoured asset for investors seeking stability amid economic uncertainties and geopolitical tensions. Watch our YouTube channel for our analysis.