The USD has been flexing its muscles in recent times, gaining strength amidst a climate of uncertainty and speculation. One of the primary drivers behind this upward trajectory has been the anticipation and implementation of interest rate hikes by the Federal Reserve.

As global economic dynamics continue to shift, the USD remains a safe haven for investors seeking stability. This article explores the factors contributing to the USD strengthening and its potential impact on the global economy.

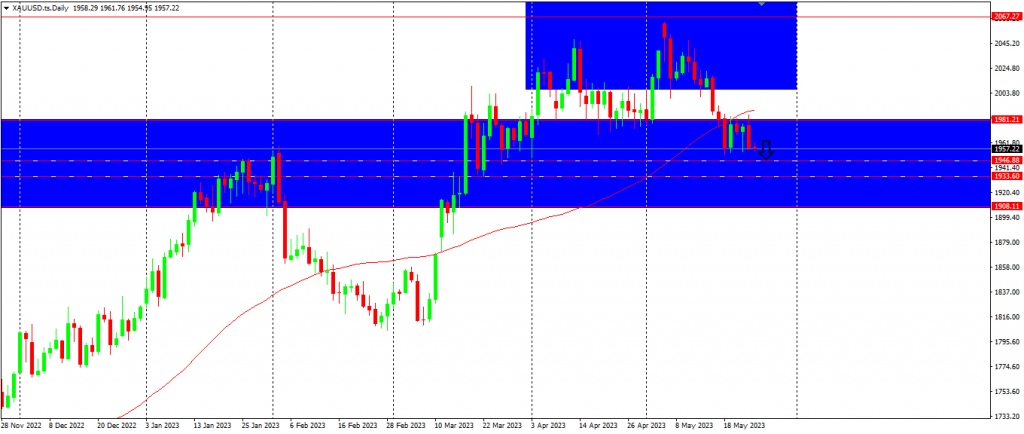

The XAUUSD Performance

Gold is still trading between 1981 & 1946.

Waiting for the breakout and close below 1946 to target 1908. Traders are closely monitoring the ongoing debt ceiling and the likelihood of more raised interest rates. The US Dollar moved to its highest levels in two months, FOMC minutes showed a mixture of some investors seeing a need to raise interest rates while others felt the opposite. While the fundamentals are mixed, the technicals show more upside for the dollar to about 105 points on the index.

The BTCUSD Performance

The correlation between BTCUSD and the S&P500 seems to be standing on the weekly chart. We are still in the retracement phase at the same support level with no movement yet. If the price breaks and closes above 31816.52, more upside to the price level of 42547.38. This requires more patience for price action to occur.

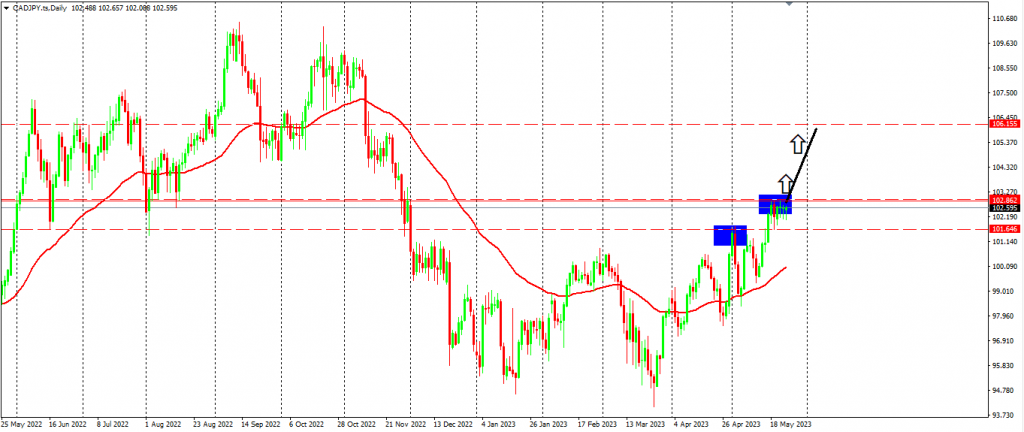

The CADJPY Performance

Still trading at the 52-week high, a break above the average would be for a longer-term hold for buyers. A close above 102.939 is more short-term hold to target at 106.155. Monitor and look for a daily timeframe close giving an indication that we are currently in a bullish move.

A high has been created at 101.646 & a higher high at 102.939 giving an indication that we are currently in a bullish move. Resistance is still taking place at 102.862 with a possible retracement down first before we move ahead. Monitor the Canadian index, it is currently sitting in consolidation in a bearish zone as well.

Read More: EURAUD Bearish Pattern Anticipated

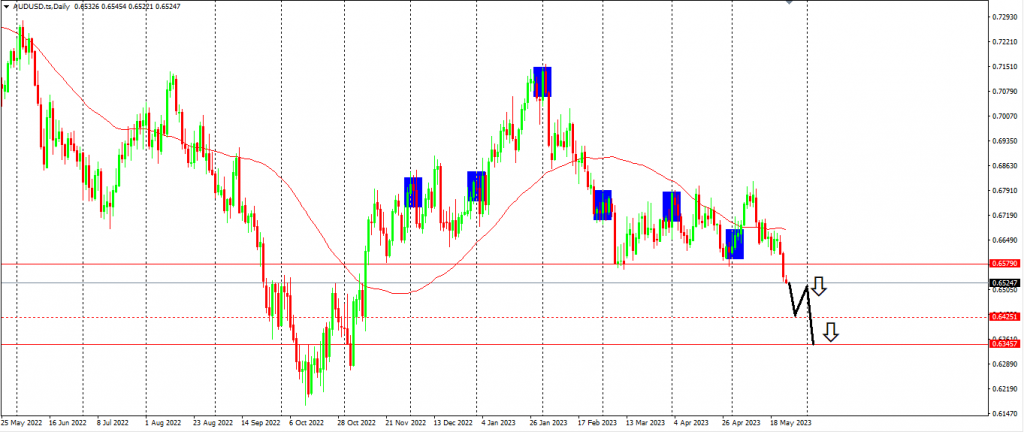

The AUDUSD Performance

Price is well below 6 monthly price pivots, strength sitting with the US Dollar. It is trending below the 52-week average, signalling more downside on this pair. Break and close below 0.65790 has been continued with a target to the price level of 0.63457. Possible pause and retracement around 0.64251 for traders to get into the move down.

Final Thoughts on Today’s Analysis

The US dollar's recent strengthening amidst uncertainty and interest rate hikes reflects its status as a safe haven currency and investor confidence in the US economy. The Federal Reserve's proactive approach to combating inflation and maintaining economic stability has played a crucial role in bolstering the dollar's value.

However, the appreciation of the US dollar also poses challenges and risks, particularly for US exporters and emerging market economies. As global economic conditions continue to evolve, it remains crucial to monitor the US dollar's trajectory and its impact on the broader global economy.