The US30, NAS100, and AUDNZD are three popular financial instruments that have recently resumed their trends after experiencing fluctuations in their prices. In this article, we will take a closer look at each of these instruments and the reasons behind their recent trend resumption.

The AUDNZD Performance

(UPDATE) - AUDNZD has dropped +80 pips.

AUDNZD bounced from the resistance zone around 1.08834 which is aligned with the descending trendline and the 61.8 fib level. This price action has resumed the trend, and the market has dropped +80 pips. Traders are bearish and have targets set at the demand zone.

The NAS100 Performance

(UPDATE) - The NAS100 trend has resumed.

NAS100 has completed the bullish continuation pattern and has resumed the trend. This pattern was in confluence with the support zone around 12818.86 and the ascending trendline which is in line with the overall bigger ascending structure and trend. Therefore, traders are bullish and are looking for retracements to identify trading opportunities.

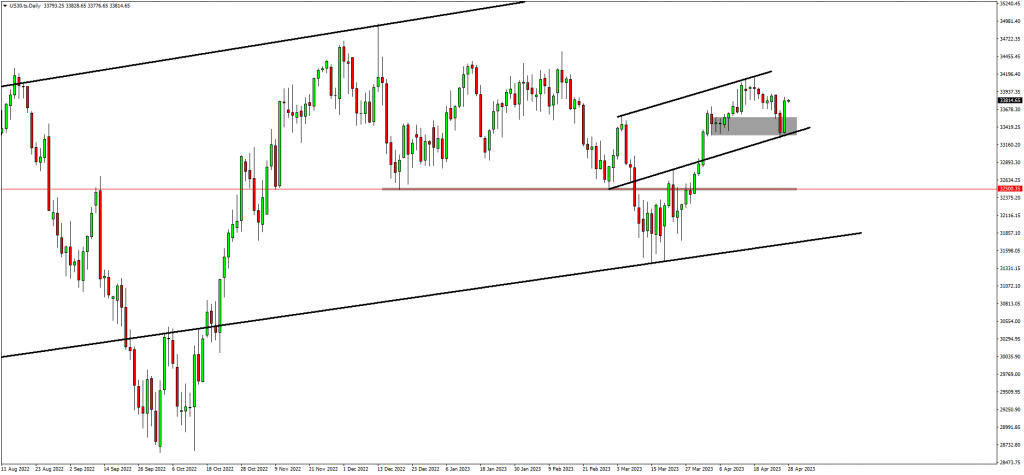

The US30 Performance

(UPDATE) - US30 also resumes the trend.

The Dow Jones Industrial Average, often known as the US30, is a stock market index that monitors the performance of 30 big publicly listed firms in the United States. The index dropped significantly in early 2020 as a result of the COVID-19 pandemic, but it has since rebounded and is now trading around all-time highs. The current continuation of the trend is attributed to solid economic statistics and the prospect of a robust post-pandemic rebound.

US30 has aggressively bounced from the demand zone which is aligned with the bottom of the ascending channel. This price action indicates a continuation of the trend to the upside. As such, traders are bullish and are looking for trading opportunities at the top of the channel.

Final thoughts on today’s analysis

In conclusion, the US30, NAS100, and AUDNZD have all resumed their trends after experiencing fluctuations in their prices. Positive economic data, strong earnings reports, and changes in demand and supply factors have all contributed to these trends. Traders should continue to monitor these instruments closely to identify potential trading opportunities and manage their risk accordingly. Looking at learning more? Join us today for a breakdown of these instruments today!