The financial markets are showing some interesting developments with particular attention to the performance of GOLD. After a period of consolidation, GOLD is once again resuming its bullish structure, indicating a potentially profitable opportunity for investors.

Meanwhile, NAS100 is also displaying a positive outlook, further adding to the bullish sentiment. On the other hand, GBPNZD is currently reaching its weekly resistance, indicating a potential obstacle for traders looking to take long positions. In this context, it's important for investors to carefully consider their options and make informed decisions based on the latest market data.

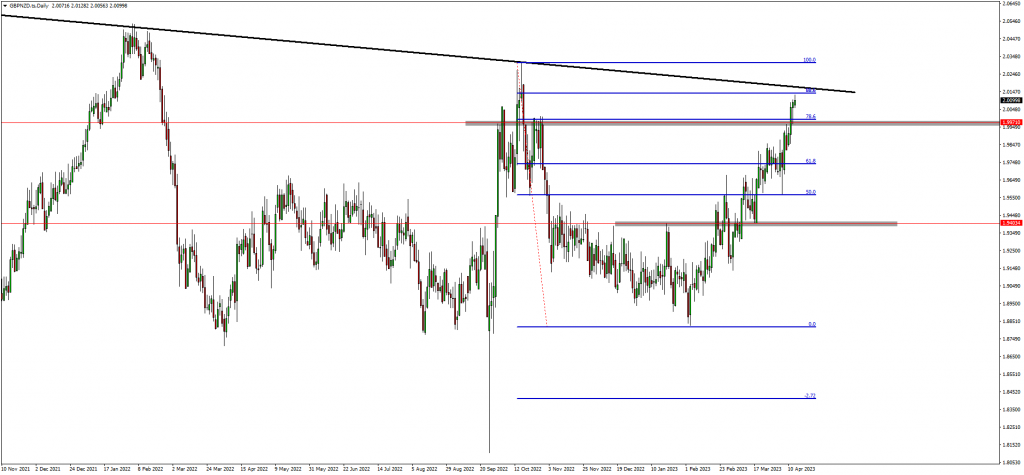

The GBPNZD Performance

Are traders preparing for NZD recovery against the Pound? The market is approaching a weekly timeframe resistance trendline which previously caused a drop in price. This area is also the 88.6 retracement according to the Fibonacci retracement tool.

According to these levels, buyers might start to take some profits and exit their positions which could cause NZD to recover and drop to the support zone around 1.99700 and a short-term trading opportunity. As such, traders are watching the lower timeframes for bearish momentum.

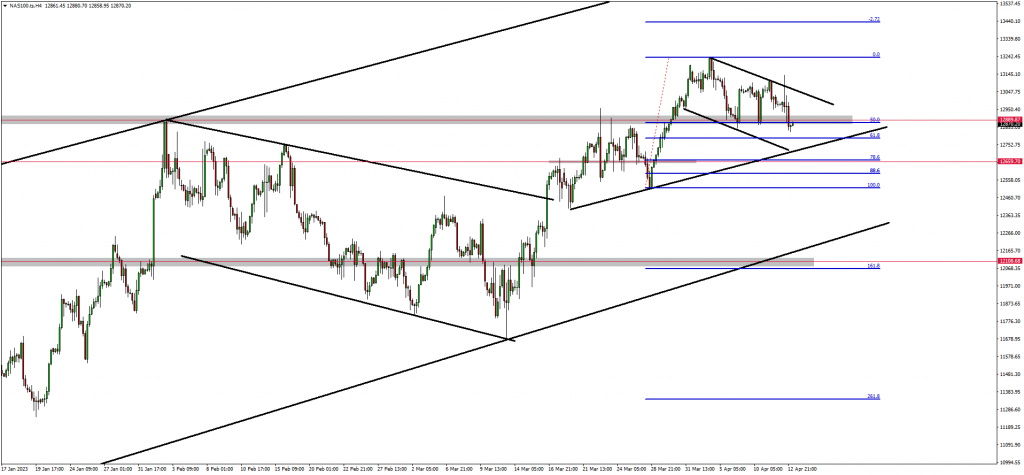

The NAS100 Performance

(UPDATE) - NAS100 is about to resume the bullish structure.

NAS100 recently broke past the previous resistance zone around 12889.00 which traders anticipate to turn into a support zone. This resulted in a higher high being created and confirmation of more bullish momentum.

At the moment the market has corrected 50% of the impulse wave according to the Fibonacci retracement tool and is also testing the support zone. According to this price action, traders are looking for more bullish trading opportunities and anticipate NAS100 to continue the bullish trend and create new higher highs.

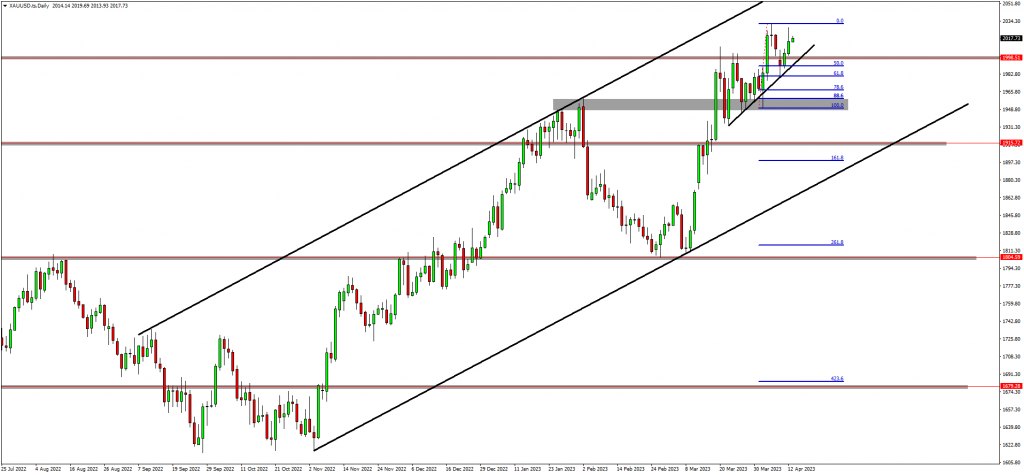

The XAUUSD (GOLD) Performance

(UPDATE) - GOLD is trading above $2000.

GOLD recently broke past the $2000 price level as well as the resistance zone, formed a retracement and is now pushing higher. This is in line with the overall structure and market sentiment as traders are not looking to short GOLD. As such, traders anticipate GOLD to hit $2050.0 and ultimately complete the bullish setup by hitting $2070.0.

Read More: Introduction to Cryptocurrency

Final Thoughts On Today's Analysis

In conclusion, the current market dynamics suggest that GOLD and NAS100 are set to continue their bullish trends, presenting a favourable opportunity for traders seeking to make profitable investments. However, it's important to remain vigilant as the financial markets can be unpredictable, and unexpected developments could potentially impact these trends.

Additionally, the recent resistance levels encountered by GBPNZD highlight the need for a cautious approach when trading this currency pair. Overall, it's crucial for traders to stay informed and keep a close eye on market developments to make well-informed investment decisions.