In the world of finance and investing, there are always opportunities to be found in the markets. In recent times, some investors and traders have been closely watching the price of gold. This has some analysts to predict that gold may be headed back to $2000 per ounce.

Along with this, there are also opportunities arising in currency markets, such as taking profits on the USDZAR and CADJPY pairs. In this context, it's important to understand the factors driving these trends and what strategies investors may employ to capitalise on them.

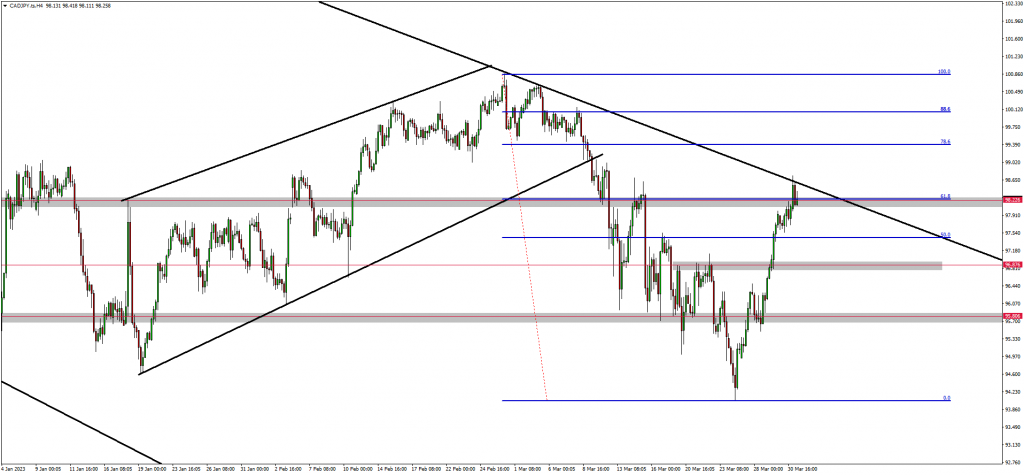

The CADJP Performance

CADJPY is now trading at the top of the descending channel.

This price action comes after an aggressive rally from the support zone around the 95.800 level. Moreover, the top of the channel is in line with the resistance zone around 98.220 as well as the 61.8 fib level. Traders who are holding long positions would want to take profits as the market could reject and drop. As such, a short-term sell opportunity down to 96.870 and traders were waiting for it.

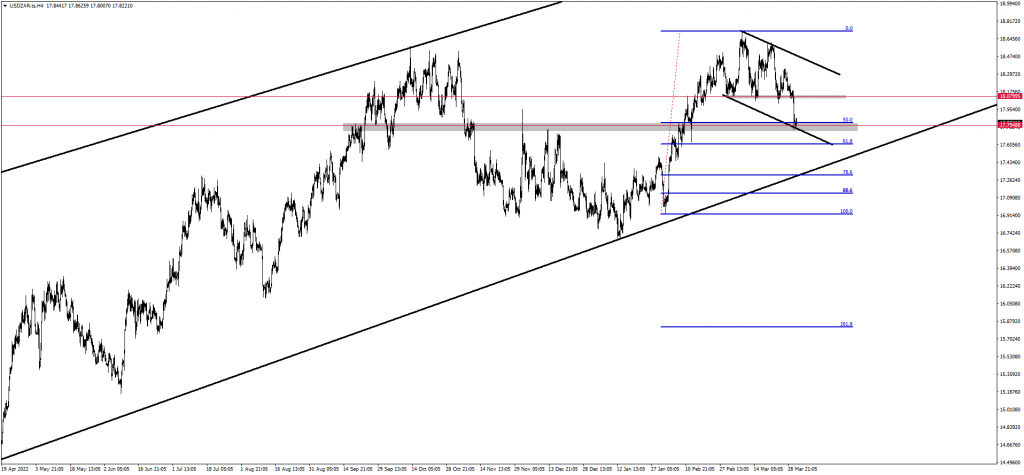

The USDZAR Performance

USDZAR dropped to the lows of the channel.

This comes after the SARB announced the interest rates yesterday. From a technical point of view, traders have identified a support zone around 17.79400 which aligns with the 50.0 fib level. Since the overall market structure is bullish, traders anticipate a rejection around this zone and a continuation of the trend with targets set around the 18.0000 price level. As such, this price action will provide trading opportunities.

The GOLD Performance

(UPDATE) - GOLD is still creating a bullish market structure.

Recently the market retraced back to the support zone around 1958.80 and continued to the upside. However, this bullish outlook is further confirmed by the 3rd test of the ascending trendline. As such, traders anticipate a rally back to $2000.

Final thoughts on GOLD heading back to $2000

In conclusion, the recent movements in the markets present unique opportunities for investors and traders alike. The potential resurgence of gold to $2000 per ounce suggests a strong bullish sentiment towards the precious meta.

Meanwhile, profit-taking opportunities on currency pairs such as USDZAR and CADJPY may arise from shifts in global economic conditions and monetary policies. As with any investment decision, it's important to conduct thorough research and analysis to ensure that one's strategy aligns with their risk tolerance and financial goals.

By staying informed and agile in response to market changes, investors can position themselves to capitalise on these trends and potentially achieve their desired returns.